More Details about ViteX Economic Model

-

At the end of February, we teased the upcoming release of a decentralized exchange. We are now delighted to announce that we have determined the final economic model for ViteX, including transaction fees and ways to obtain our DEX’s token, VX.About VX

What is VX?

ViteX Coin, VX, is the coin native to the ViteX platform. It is mined exclusively by the ViteX community and is used to allocate rewards back to the community.

VX holders can receive daily dividends from a shared dividend pool which aggregates all trading & listing fees accumulated by ViteX and redistributes back to VX holders.Rules of VX’s Distribution

The total supply of VX will be 29328807.8 with no inflation. The total supply of VX will be fully distributed in two phases.- Phase 1: Buffer phase that has ended on December 6, 2019. A fixed amount of 10,000 VX was released daily.

- Phase 2: Standard Phase. In this phase, all un-mined VX will be released according to below schedule:

Sub-phase 1: Starting at 10,000 from December 7, 2019, daily release will increase for 90 days at a fixed rate until reaching 50,000 on March 6, 2020

Sub-phase 2: Starting from March 7, 2020, annual release will decrease by half each year until fully distributed after 8 years.

Among all VX issued in one day, 60% will be distributed to traders, 30% to VITE stakers for ViteX, and 10% to Vite Labs.

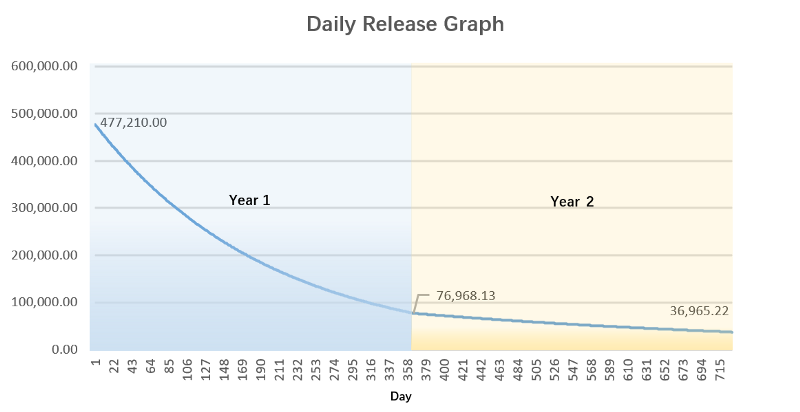

The number of mined VX will decrease by 0.5% every day in the first year. 477,210.00 VX will be released on the launch date of ViteX. 76,968.13 VX will be released one year after the launch. Thus, 80.13% of total supply will be released in the first year. The number of mined VX will decrease by 0.2% every day in the second year. 76,660.56 VX will be released on the first day of the second year and 36,965.22 VX will be released on the last day of the second year. The daily release volume of VX is depicted below.

How to get VX?

You can get VX in three ways. The first way is to trade on ViteX (“Trading is Mining”); the second way is to stake VITE and help ViteX receive quota for its operations (“Staking is Mining”); the third way is listing trading pairs (“Listing is Mining”)-

Trading is Mining: 60% of daily released VX will be distributed to traders according to the proportion of their transaction fee on ViteX (token issuers also take a share in this transaction fee pool, as explained below); Currently there will be four markets: BTC market, ETH market, VITE market, and a stablecoin market. Each market will equally share 15% of the daily distribution.

-

Staking is Mining: 30% of daily released VX will be distributed to users who participate in staking VITE for the benefit of ViteX. That is, to receive VX, these users must stake VITE and set ViteX’s smart contract address as the quota beneficiary. The VX distributed to each staker is in proportion to the amount staked.

-

Listing is Mining: A user (“token issuer”) that lists a new trading pair will receive VX. As mentioned earlier, the token issuer receives VX by participating in the same pool as traders, with his share calculated as if he executed a trade involving a transaction fee of 1,000 VITE. A listing fee is required for the DEX: For a token issued on Vite chain, the listing fee is 10,000 VITE. Otherwise, a cross-chain gateway will be involved in the listing, and a related fee may be added.

-

Dividends for VX Holders: If you are holding more than 10 VX, you will continuously obtain the bonus of daily trading and listing. Although VX is only obtained by mining, VX will be able to trade on ViteX. We can simply regard VX as a stock certification of ViteX.

Note: A minimum amount of VX is required to receive a dividend. A VX holder must have at least 10 VX in his ViteX account. Otherwise, no dividend will be allocated.

Transaction Fees

Transactions on Vite chain will not consume gas (as will transactions on Ethereum), but will consume a different type of resource we call “quota.” The quota will be offered for free for transactions at a low frequency. This is no longer the case for transactions at a higher volume. ViteX requires a large quota to operate, given its nature as a high-frequency trading dApp. Transaction fees are meant to partially offset the consumption of quota. Transaction fees will be denominated in “basic currencies,” such as VITE, ETH, BTC, and a stablecoin. The rules are as below:Trading fees

0.5% will be collected from takers and makers. All transaction fees will be re-distributed among VX holders.Withdrawal fees

There are no fees for deposits and withdrawals between Vite wallet and ViteX; only quota will be consumed in these cases. When assets are withdrawn to non-Vite wallets, the cross-chain gateway will charge a certain amount of withdraw fee.Summary

VX holders will share all transactions fees and other incomes from ViteX. VX has no pre-mining, pre-sale, private sale, or public sale.-

Trading is Mining: Traders on ViteX receive VX tokens.

-

Staking is Mining: Users staking VITE to provide ViteX’s smart contract with transaction quota will receive VX tokens.

-

Listing is mining: Token issuers that list new trading pairs on ViteX will receive VX tokens.

ViteX Community

Telegram: https://t.me/vitexexchange

Twitter: https://twitter.com/ViteXExchange

-

@Choeriswangqiji what will be the requirements for listing to ViteX?

-

Hello,

Trading fees at 0.5% is not reasonable. Are you sure it's not a typo for 0.05%? No trader will use an exchange with such high fees.

If you need advice/recommendation from a crypto trader for anything related to your exchange (UI/UX, fees model, etc.) don't hesitate to contact me, I'll be happy to help.

Cheers

-

Agree on fees. Why not at least start at 0.05% or even 0.08% (or 0%?) to build some volume?

-

0.5% fees! It's 10x what I expected... Why DAG if it is to set so high fees?

-

@Krillin It is reasonable. LET Me tell you why. First as mentioned above, all transaction fees will be distributed to the VX holders, in other words, ViteX will not take any of your crypto assets. Even though, ViteX will take 10% of every transaction fees as already published in this article, which means 10% * 0.5% = 0.0005 (0.05%) as a transaction fee (that will be 100x higher in other exchanges)

-

@nik12 It is reasonable. LET Me tell you why. First as mentioned above, all transaction fees will be distributed to the VX holders, in other words, ViteX will not take any of your crypto assets. Even though, ViteX will take 10% of every transaction fees as already published in this article, which means 10% * 0.5% = 0.0005 (0.05%) as a transaction fee (that will be 100x higher in other exchanges)

-

@JD It is reasonable. LET Me tell you why. First as mentioned above, all transaction fees will be distributed to the VX holders, in other words, ViteX will not take any of your crypto assets. Even though, ViteX will take 10% of every transaction fees as already published in this article, which means 10% * 0.5% = 0.0005 (0.05%) as a transaction fee (that will be 100x higher in other exchanges)

-

@felicity Later details about listing a coin will come out.

-

@Choeriswangqiji said in More Details about ViteX Economic Model:

@Krillin It is reasonable. LET Me tell you why. First as mentioned above, all transaction fees will be distributed to the VX holders, in other words, ViteX will not take any of your crypto assets. Even though, ViteX will take 10% of every transaction fees as already published in this article, which means 10% * 0.5% = 0.0005 (0.05%) as a transaction fee (that will be 100x higher in other exchanges)

I don't understand your sentence, sorry, can you rephrase?

-

@Krillin ViteX will only take 10% of total transaction fees for daily operations. And the rest of 90% of transaction fees collected will be allocated to all traders on ViteX if they are holding VX in their account. So that means 0.5% * 10% = 0.05%.

-

- Sorry, but 0.5% is everything but reasonable, my bank takes less fees. It's the highest fee of the all market.

- You are speaking like everybody will be VX big holder...

- As a full time trader, I tell you, I will never trade with 0.5% fee, it is just a fact, and you can ask other traders.

- As a DEX, you can be cheaper than other exchanges, and as a DAG based DEX, you can be cheaper than other DEX.

So your model is good only for VX whale, but not for users (especially vite token users). To me 0.5% is a deal breaker. It's just my honest opinion, I hope you will do a comparative analysis and see that your fees are 5x higher than the all market. Fee level is the 1st thing traders look at. Exchange token must be an incentive, not the inverse.

Peace.

-

@nik12 Thanks for your kind advice. I will report to our dev team.

-

@Choeriswangqiji sorry but you're totally missing the point.

If I want to buy VITE with BTC on the DEX, you will take 0.5% of the amount of VITE I am purchasing. And this is not acceptable.

-

@Krillin Yes, and how about you will receive some VX in return and you will receive dividends every day since then? So what do you think?

-

@Krillin agree, whatever if it goes to a VX holder. It a 0.5% fee, so it's a 0.5% loss.

-

@nik12 But you get transaction fees in return, that will compensate the called loss.

-

@Choeriswangqiji Token exchange must be an incentive, not the inverse.

-

@nik12 It is an incentive.

-

@Choeriswangqiji In this case, collecting a 0.5% fees it is a deal breaker for many, and a good incentive for a few. My pm is open for more feedback.