Excellent article from our CMO @lukekim153, which incorporates all the basic information about SBP's.

https://medium.com/vitelabs/supernode-101-earn-vite-rewards-daily-a47027401cab

Oleg

@Oleg

Crypto-enthusiast, Investor, Entrepreneur, Community manager.

Telegram: @Enthusiast1

Best posts made by Oleg

-

⛓Everything You Need to Be a Snapshot Block Producerposted in General

-

Vite Bi-weekly Report - April 16~30, 2019posted in Bi-Weekly updates

Vite Bi-weekly Report

April 16~30, 2019

Recent milestones

DEX

- On April 16th, the ViteX beta version was launched. Click on this link to check out our DEX. We will be providing test tokens so that you can simulate a real trading experience! Instructions can be found here.

- On April 23rd, the ViteX round 1 voting results were announced. Based on your feedback, the following changes will be implemented: 1) Vite X will have transaction rate fees of 4% and 2.5%, 2) an additional 10,000 VITE staking quantity to reduce fees by an additional 1% and 3) staking duration to become a ViteX VIP will be 30 days

- On April 25th, the ViteX shared pool voting results were released. Based on the results, ViteX will be setting up a shared dividend pool with a daily distribution rate of 1%.

Binance Info

- On April 20th, Vite officially joined Binance Info’s transparency initiative to provide users with trusted and reliable information on crypto projects. We obtained a “V” label certification, which means that the content shown on the project page will be personally updated by the Vite team.

Wallet Updates

- On April 22nd, the Vite iOS 2.1.0 wallet was officially released with support for: 1) GRIN transactions, and 2) wallet referrals. You can now share your referral code and win up to 68,000 VITE. More details on this campaign here.

- On April 24th, the Android Vite wallet app update was released with the wallet referral function.

System Developments

Go-Vite

The Vite Pre-Mainnet is still under testing. The engineering team is hard at work to:

- Debug the upcoming Pre-Mainnet.

- Optimize the contract address.

- Add support for contract quota and third-party staking.

- Add a new function to facilitate quota status inquiries in third-party staking situations.

- Map out product migration process to the Pre-Mainnet.

And last but not least:

- Java-SDK Pre-Mainnet adaptation is complete. The corresponding code can be viewed on GitHub.

Vite Wallet App

Completed:

- Vite Wallet iOS 2.1.1 was released with new features supporting GRIN and wallet referral program.

- Vite Wallet Android 1.5.0 version was released with support for the wallet referral program.

- Pre-MainNet iOS SDK adaptation was completed.

- Fixed bugs in the built-in DEX

- The ViteJS 2.0.0 document was completed: (https://vite.wiki/api/vitejs)

Under development:

- Development for the iOS in-Wallet one-click token conversion feature is 20% complete.

- Continued optimization for in-wallet GRIN transactions. After optimization, the wallet will support queries for transaction progress as well as transaction type

- The development of Android 2.0 ETH wallet is 20% complete.

- Android Pre-Mainnet adaptation is in progress.

The Android 1.5.1 version has been tested and is ready for release. - The development of ViteJS 2.1.0 Pre-Mainnet adaptation is 90% complete.

Official Website & Block Explorer

- We’re revamping our official website. It is now 95% complete. We can’t wait to show you the new design!

- The block explorer adaptation to Pre-Mainnet is 30% complete.

SyraCoin

- The first phase of the SyraCoin project back-end has been complete.

- The demo version of the SyraCoin iOS App was developed and is under review.

ViteX

- Continued optimization of the performance back-end services including data storage, request consolidation, and long link protocol optimization.

- The exchange contract adaptation to Pre-MainNet is 20% complete.

- Cross-chain gateway registration services have been completed.

Community Building

- Two weeks ago, Vite launched a global community expansion initiative. We asked our community members who were interested in becoming Vite community managers to apply. We’re happy to announce that the recruiting process has been completed — thank you to all those who showed interest! Links to the new telegram groups can be found at the end of this article.

- As you all know, we launched the Vite mobile wallet referral program on April 23. In addition to the basic referral rewards, the top 50 addresses with the most referrals will receive extra prizes. Details can be found here.

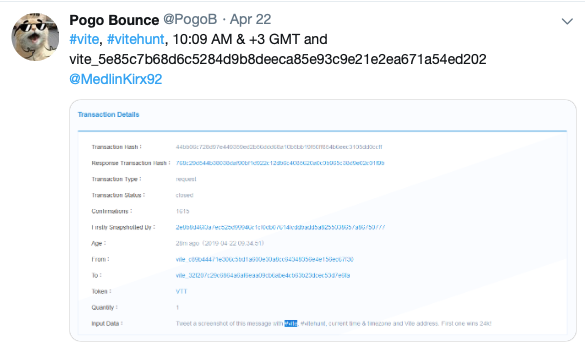

- Back in March, the Vite released a puzzle campaign on Twitter. The campaign was finished on April 16th —congratulations to @PogoB for being a puzzle master and winning 24,000 VITE!

- Last month, we began searching for Indonesian speakers to help us translate our wallet app. After a strict screening process, the translators have been selected. Stay tuned for a Vite wallet update that will support Indonesian.

Activities

On April 20th, Tong Wang, Director of Operations of Vite Labs, was invited to participate in the China Blockchain Application Research Center Director’s Meeting. During the meeting, the directors discussed successful applications of blockchain and how to increase public awareness of blockchain technology.

Official: https://www.vite.org/

Twitter: https://twitter.com/vitelabs

Vite Forum: https://forum.vite.net

Telegram:

- English: https://t.me/vite_en

- Chinese: https://t.me/vite_zh

- Russian: https://t.me/vite_russian

- Korean: https://t.me/vite_korean

- Japanese: https://t.me/vite_japanese

- Vietnamese: https://t.me/vite_vietnamese

- Thai: https://t.me/vite_thai

- Arabic: https://t.me/vite_arabic

- German: https://t.me/vite_german

- French: https://t.me/vite_french

- Turkish: https://t.me/vite_turkish

- Indonesian: https://t.me/vite_indonesian

- Spanish: https://t.me/vite_spanish

- Malaysian: https://t.me/vite_malaysian

- Filipino: https://t.me/vite_filipino

Discord: https://discordapp.com/invite/CsVY76q

Reddit: https://www.reddit.com/r/vitelabs/

Facebook: https://www.facebook.com/vitelabs/

-

Vote for your Vite Community SBPs!posted in Announcements

Vote for your Vite Community SBPs!

(Because we’re phasing out the official Vite SBPs)

If you’ve been following along, you’ll know that Vite successfully completed its migration to the Pre-Mainnet last week. The Pre-Mainnet is a major upgrade from the Testnet, including significant upgrades and improvments to data ledger storage structures and operating efficiency.

As part of this transition, we will be phasing out the official Vite SBPs in order to promote fair and equal competition for the community SBPs. By June 5, 2019, all the official Vite SBPs will be removed from the SBP list. If you have voted for any of the official Vite SBPs, now is the time to take that vote and cast it for a community-run supernode. If you don’t re-vote, you will no longer receive any rewards from the official Vite SBPs (since they won’t exist anymore).

So, to reiterate: GO VOTE.

How do I decide who to vote for?

At the moment, there are 39 community supernodes — they can be found here. Additionally, we are working on an SBP introduction page with more detailed information about the people behind each SBP here. Please note that this list is not yet complete (we only have about 13 SBPs listed at the moment).

How do I get listed on the SBP page?

If you’re an SBP and haven’t completed this form, please complete this form so that we can feature you as an official community SBP on the web page above.

How do I vote for an SBP?

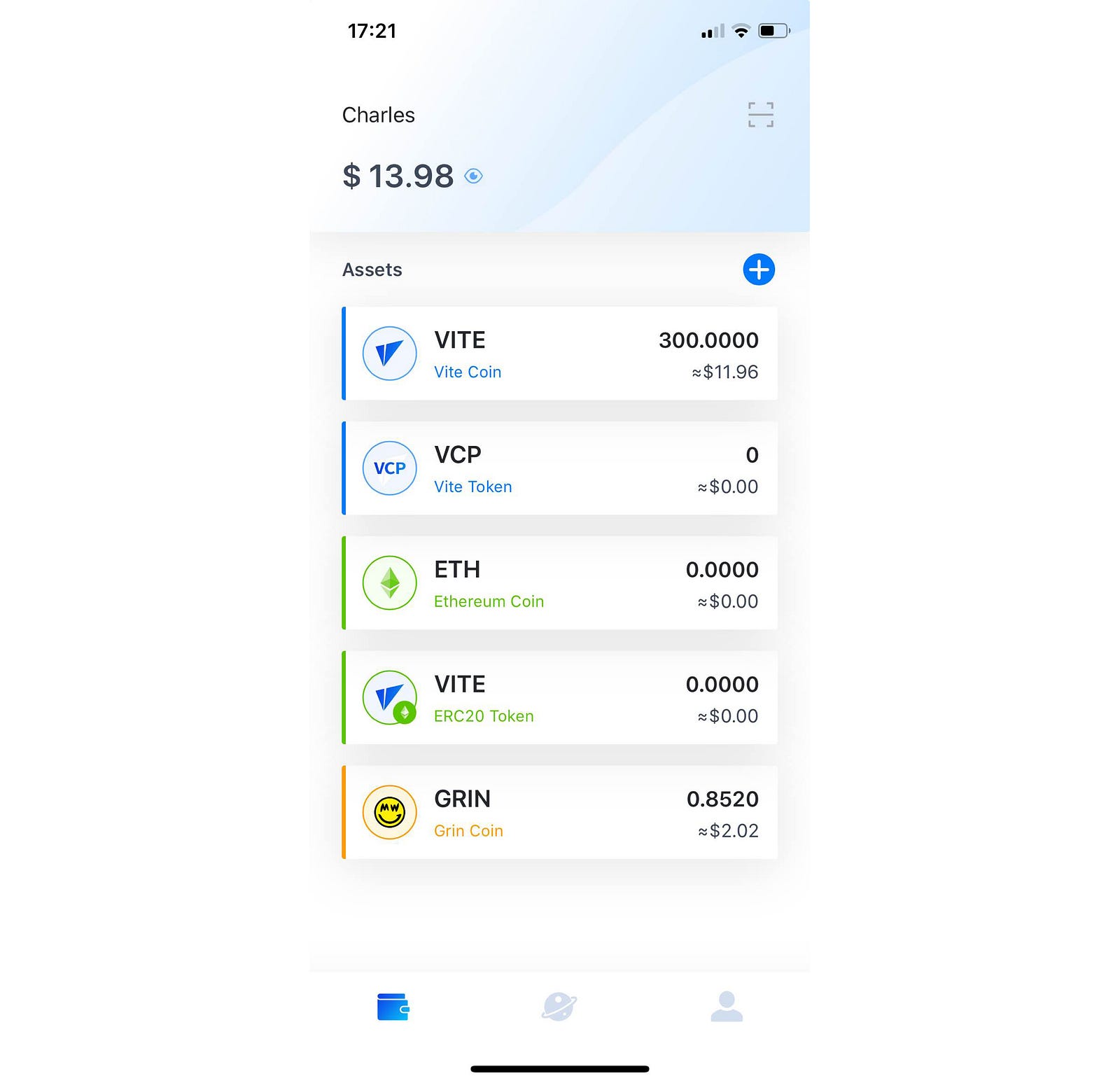

Voting is super easy. First, open up your wallet and select the “Vite” bar from the home page.

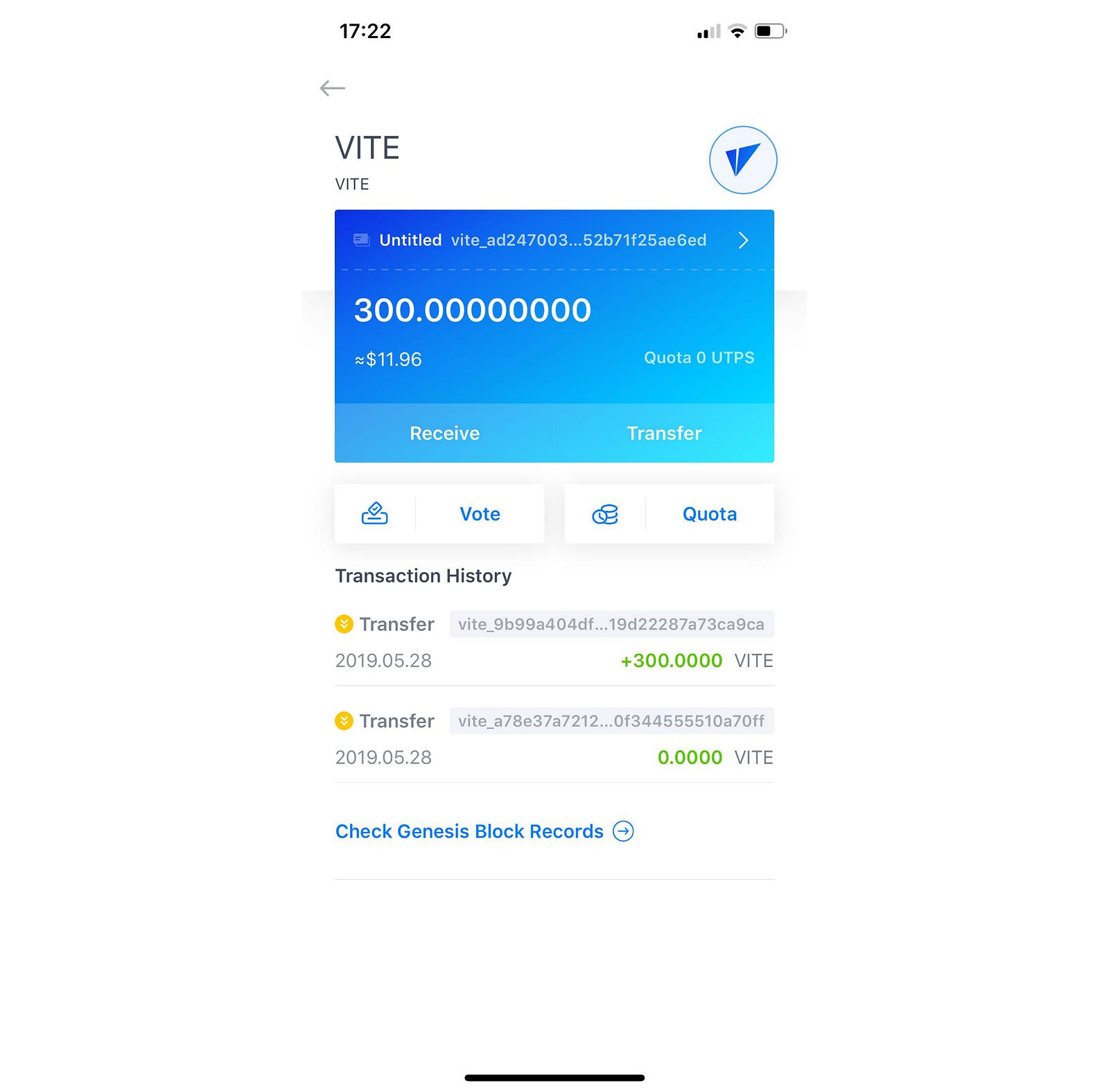

Once you open up your Vite holdings page, you should see a “Vote” button. Click on it.

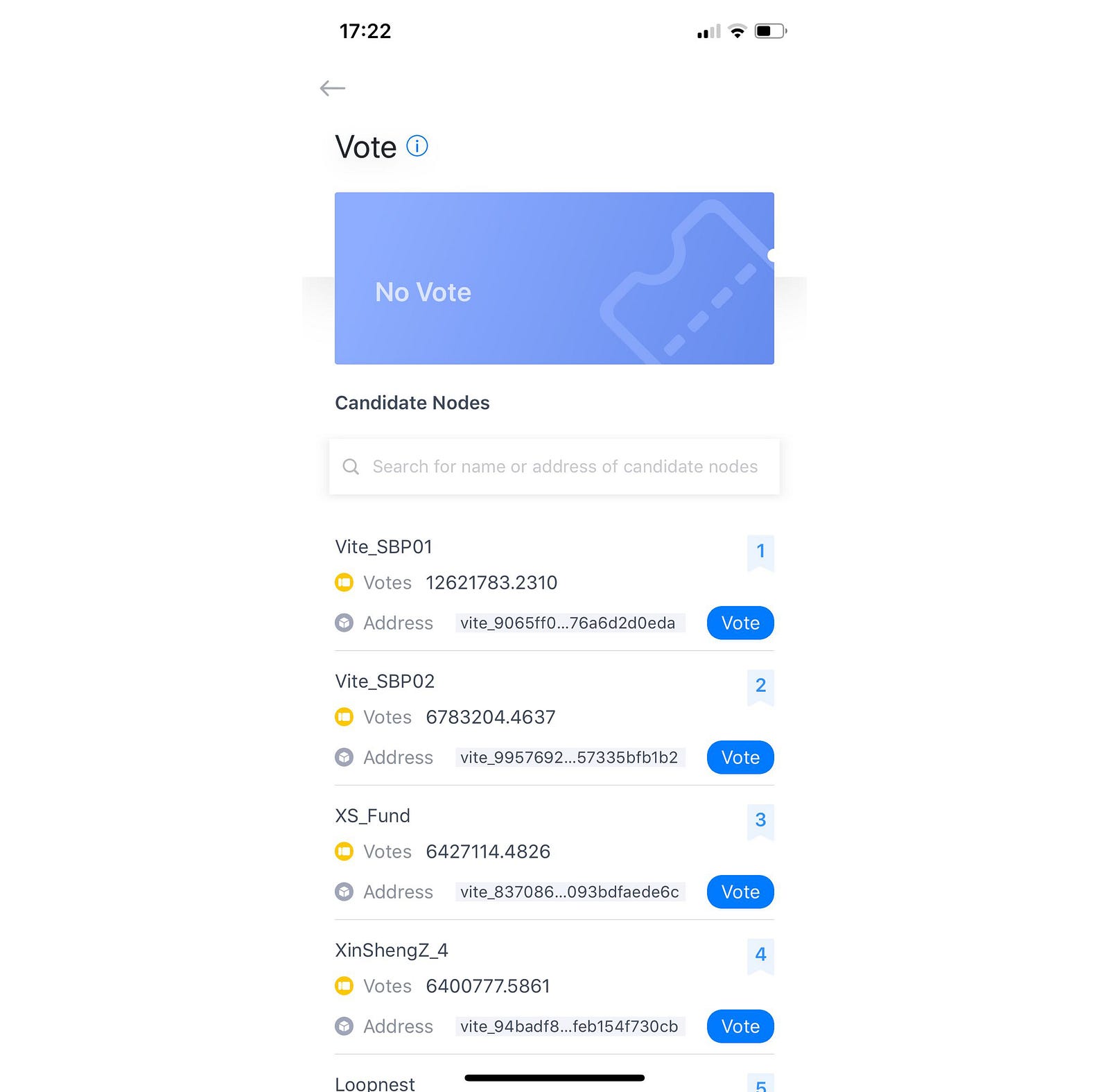

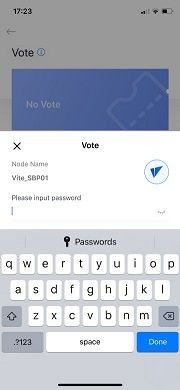

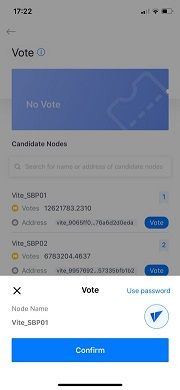

You’ll be taken to a list of all the available candidate nodes, where you can select your preferred node by clicking the “Vote” button.

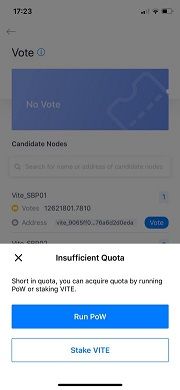

Once you have selected your node, you’ll need to input your password, confirm your selection, and, if applicable, run a quick PoW to complete the action. Obviously, don’t do what the screenshots below are suggesting by voting for an official Vite supernode (since they will be removed). We didn’t want to bias anyone towards any of the community SBPs.

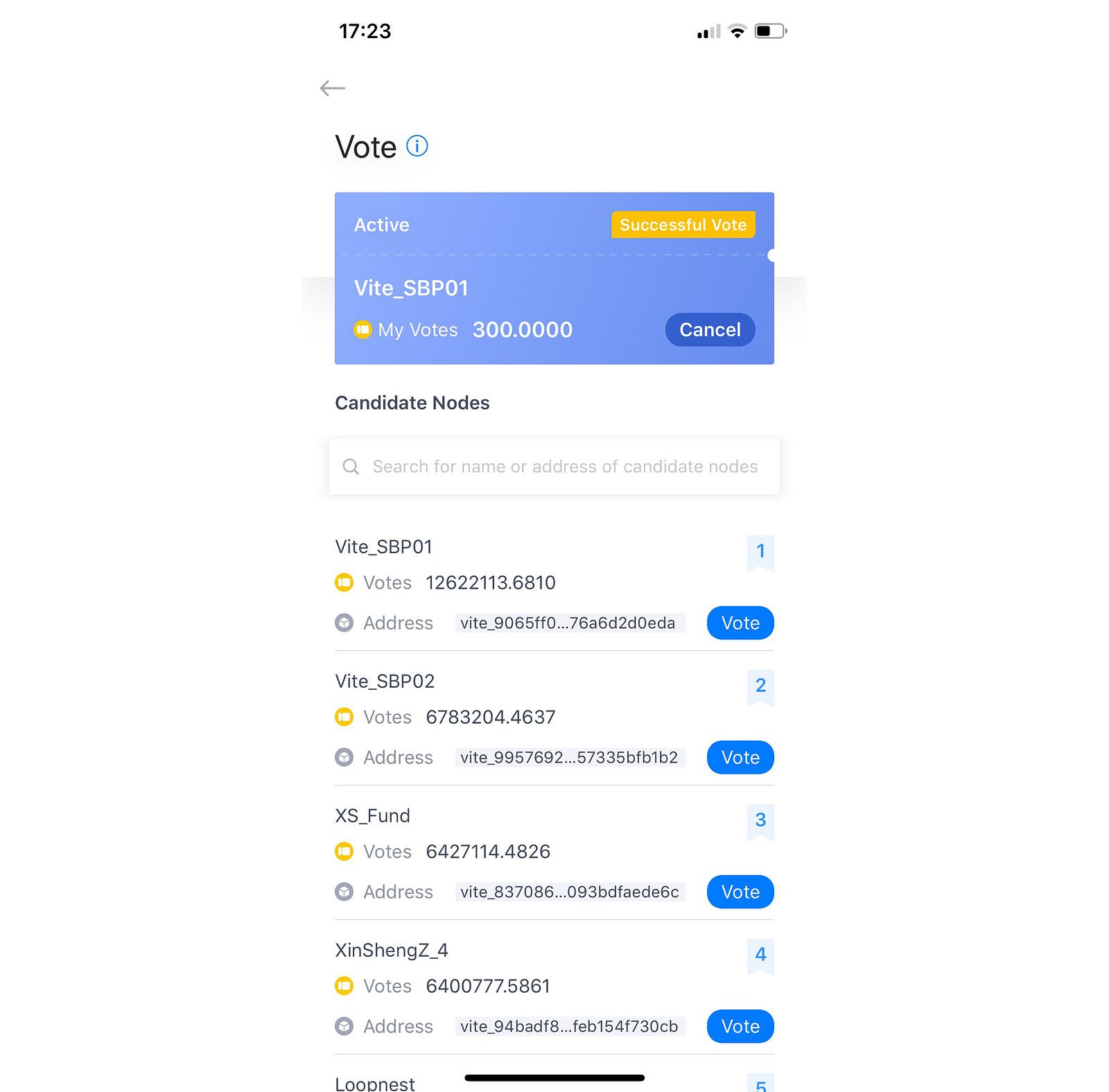

After a successful vote, your screen should look something like this:

And…that’s it! Happy voting!

-

Vite Bi-Weekly Report - March 1~15, 2019posted in Bi-Weekly updates

Vite Bi-Weekly Report

March 1~15, 2019

DEVELOPMENT PROGRESS

[go-vite]

Go-vite now supports transaction subscriptions and contract event subscriptions. We have begun developing the go-vite framework named “Vite Pre-MainNet” including multi-system optimization:

- Finished 50% of the data mapping scheme development from TestNet to Pre-MainNet.

- Optimized data structure on chain, optimized account block structure, removed display reference and snapshot hash, decreased complexity of snapshot chain and user chain cross referencing to reduce fork rate.

- Redesigned the quota calculation method.

- Contract chain now supports RS block; RS block is a special block composed of one response and multiple requests to improve the storage efficiency of the contract chain.

- Improved optimization of random number implementation scheme.

- Optimized ledger storage scheme. The physical structure has been optimized and random writing has been changed to sequential writing. Multi-level storage improved query cache hit rate.

- Optimized ledger synchronization scheme to decouple the logic of downloading and writing in order to achieve asynchronous downloads of the ledger.

[Vite Applications]

Completed:

- Android Version 1.3.1 test and release: strengthened airdrop anti-cheating security and implemented fingerprint payment function.

- iOS Version 2.0.0 upgrade and ETH access: iOS 2.0.0 is ready for testing.

- Web Wallet Version 1.4.0: decentralized exchange (DEX) wallet user interface upgrade, as well as function testing of K-line graph and DEX, are completed.

- Vitejs Version 1.2.1 released: supports publishing subscriptions and optimizations. Technical documentation available: https://test.vite.wiki/api/vitejs/.

Under Development:

- Web Wallet Version 1.5.0 user interface upgrade complete. Token listing and login logic 50% complete.

- Vitejs 2.0.0-alpha features major changes: feature package splitting, code structure refactoring, business logic refinement (e.g. support for address type recognition).

[ViteX | Vite Decentralized Exchange]

Cross-chain Gateway:

Mechanism for cross-chain gateway transaction confirmation complete: cross-matching through multiple data sources (self-built full node or block explorer) to confirm transactions.

ViteX:

- Optimization and testing for publish-subscribe function via persistent connection 50% complete.

- DEX back-end core service performance optimization 20% complete.

- Development of smart contract token listing is complete: the dividend function unit test if completed by 70%.

- Complete join testing of core functions including recharging, cash withdrawal, order placement, market price, depth, K-line graph.

- Development of token listing and web wallet compatibility 40% complete.

VITE MILESTONES

- On March 4th, Vite Android Wallet was updated to support airdrop functionality. Users who have questions about the update or are unable to download can check the specific collection method in the Vite forum.

- On March 6th, the TestNet was upgraded to complete the hard fork named Mint, which mainly solved the problem of block-out and added support for additional tokens.

- On March 12th, the number of Vite full nodes reached 1,000 among 26 countries.

- On March 14, the 10,000,000th snapshot block was created. The TestNet is becoming more mature and stable.

- During the second week of March, following up on our initial proposal and after months of planning, Vite Labs CMO Luke Kim presented a plan to implement SyraCoin, a first-of-its-kind municipal token economy. We received official approval by the Mayor of Syracuse. This propels our strategy of building socially meaningful use cases for blockchain.

COMMUNITY BUILDING

Bittrex Campaign:

Starting March 1st, Vite Labs held a community campaign on Bittrex. This campaign lasts until March 31st. Fans can buy VITE on Bittrex and convert to TestNet tokens, at which point they receive extra rewards.

https://forum.vite.net/topic/918/bittrex-trading-campaign-buy-vite-on-bittrex-to-earn-more-vite

CryptoDealers YouTube Interview:

Recently, Vite CMO Luke Kim and Engineering Director Allen Liu conducted an interview with a Russian / Ukranian influencer — [CryptoDealers]. The focus of this conversation was Vite’s public chain, DAG + smart contract, supernode incentives and the growth of Vite’s Eastern European community.

Based on this interview, we started quiz campaign in both English and Russian communities. Winners can check their status here:

Seeking Talented Content Creators:

We are recruiting blockchain evangelists to create content and help us with writing, video and social media. Generous rewards are available — bounty style!

https://forum.vite.net/topic/952/you-are-wanted

Q & A — ViteX

Q: Is ViteX developed by a third party or in house?

A: The ViteX decentralized exchange was developed by the official Vite team — nothing was outsourced.

Q: What are the sources of funding for VX’s future development and maintenance?

A: Funds for future development and maintenance of VX are mainly from the foundation of Vite Labs.

Q: Why build a decentralized exchange?

A: There is significant market demand for decentralized exchanges. DEX will be a trend within the blockchain industry.

ViteX can effectively demonstrate the performance of the Vite public chain, including the performance of smart contracts. ViteX will be a dApp on the Vite public chain, contributing to the ecosystem of Vite.

Q: Can you explain the VX protocol?

A: ViteX smart contract is not a protocol. The smart contract is based on the Take-Make method, which is based on the price priority order of the pending orders.

Q: What is the different between VX and other exchange tokens?

A: VX does not have a pre-sell, private-sale, nor public sale. Everyone can participate in VX mining. Users who hold VX can receive dividends of all transaction fees and token listing fees; this is highly differentiated compared to most other digital asset exchanges.

-

SnapSecure: Australian SBP + Community Leaderposted in General

SnapSecure: Australian SBP + Community Leader

Vite’s One Man Army

Matthew (a.k.a. SnapSecure / Plasmo) hailing from Australia first discovered Vite while he was on Telegram, when “some guy” from ICO Ninja distributed a list of upcoming ICOs. Matt found that most of them weren’t so good, but when he learned about Vite, decided that Vite sounded pretty legitimate (thanks Matt). He is a shining example of how you don’t need an army of computers and manpower to be one of the top Snapshot Block Producers (SBP) and a leader in the Vite community.

SnapSecure has been consistently voted among the top 30 SBP’s. They are one of the most active members on our Discord channel, constantly providing helpful advice and answering questions from others within the community who are learning about Vite.

Their website contains comprehensive articles detailing everything from technical tutorials to project updates to community campaigns.

Want to know how to set up an SBP? Find this handy tutorial on their website here. Don’t want to commit to an SBP? Learn how to set up a full node here. Want to celebrate the launch of Vite’s Full Node Incentive Program? SnapSecure created a campaign here (you can no longer sign up but it was a great campaign idea nonetheless). They even built a coin faucet that distributes Vite rewards to community members.

Some of their future plans and ideas include:

- Opening a casino on the Vite platform

- Building cool decentralized applications (dApps)

- Other cool ideas that we’re sure he’s keeping from us

Although SnapSecure will be taking down his SBP in the coming weeks as he plans to shift his focus from running an SBP to bigger and better things on our decentralized exchange (ViteX), we wanted to take the time to give a shoutout to SnapSecure for what they contributed so far to our community. We can’t wait to see what they come up with next!

What’s a Supernode? Got what it takes to be an SBP?

Check out our article entitled Supernode 101 | Earn Vite Rewards Daily. This is a 4 minute read and all necessary information is provided. Take a look at our Node List for examples of existing SBP’s.

Want Vite to Shout Out Your Team?

If you identify as one of the profiles below, contact Luke Kim, our Chief Marketing Officer. We would love to hear your story and jam out on ways to collaborate! If you are a:

- Supernode Operator and /or Snapshot Block Producer

- Builder of the Vite community and ecosystem internationally

- Developer on Vite

- Early Adopter of ViteX

We can support you in running community campaigns (e.g. subsidizing your token awards), getting you press and organizing local events (e.g. hackathons and educational workshops).

As always, stay tuned as we highlighting more SBP’s and community leaders in the future!

Official: https://www.vite.org/

Vite Forum:https://forum.vite.net

Telegram:

- English: https://t.me/vite_en

- Chinese: https://t.me/vite_zh

- Russian: https://t.me/vite_russia

- Korean: https://t.me/vite_korean

- Vietnamese: https://t.me/vite_vietnamese

- Thai: https://t.me/vite_thailand

- Japanese: https://t.me/vite_japanese

- German: https://t.me/vite_german

- Arabic: https://t.me/vite_arabic

Twitter:https://twitter.com/vitelabs

-

Vite Bi-Weekly Report - April 1~April 15, 2019posted in Bi-Weekly updates

Vite Bi-Weekly Report

April 1 - April 15, 2019

Recent Milestones

- Our fan base is growing! We created new community telegram groups for our Japanese, Korean and Arabic fans. Links to these groups are found at the bottom of this article.

- We’re looking for more community managers to help bring together other fans that currently do not have a dedicated Vite community. If you speak English and one (or more) of the languages that we do not currently support, submit an application here.

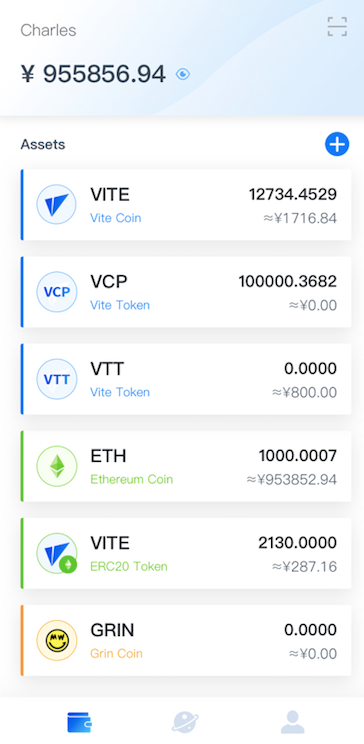

- On April 12th, the Vite iOS 2.1.0 wallet officially opened up beta testing to all users. We now support Grin! See proof below.

- Since we revealed the details of the ViteX economic model, we received an incredible amount of feedback from the community. We want you guys to be happy with our products, so with your help, we’re revising some of our original rules. On April 11th, we launched a community-wide vote to decide how you guys want the ViteX shared dividend pool to look. We want to hear your thoughts — vote here.

- On April 16th, ViteX officially launched its beta version for all users to test. Check it out here and let us know what does and doesn’t work in our bug-reporting campaign!

System Developments

Go-Vite

The Vite Pre-MainNet has completed joint development. Details are as follows:

- Development of TestNet to Pre-MainNet data mapping scheme in progress.

- Optimized data structure on-chain and account block structure, removed display reference and snapshot hash, decreased complexity of snapshot chain and user chain cross-referencing to reduce fork rate.

- Redesigned the quota calculation method.

- Contract chain now supports RS block; RS block is a special block combining one response and multiple requests to improve the storage efficiency of the contract chain.

- Improved optimization of random number implementation scheme.

- Optimized ledger storage scheme. The physical structure has been optimized and random writing has been changed to sequential writing. Multi-level storage improved query cache hit rate.

- Optimized ledger synchronization scheme to decouple the logic of downloading and writing in order to achieve asynchronous downloads of the ledger.

Vite Wallet App

- iOS: Version 2.1.0 beta is now open to testing for all users. We added some new features, which include: 1) support for GRIN transactions, and 2) support for the wallet referral program. The pre-MainNet iOS SDK adaptation is 80% complete.

- Android: Version 1.5.0 has been built and is currently under testing. Support for the referral program will be added to this version as well. The development of Version 2.0.0 is 20% complete.

- Web: The beta version of our DEX, ViteX has been completed and is now open to testing.

ViteX

- Completed the full test to resolve any bugs and meet performance requirements prior to launching the beta test.

- Deployed a public beta environment.

- Performance of back-end core services of the DEX was adjusted, including real-time statistics of indicators, batch data processing, and notification of posting subscriptions. Adjustments are 60% complete.

SyraCoin

- Completed the SyraCoin system design.

- Development for the iOS app has started and is 10% complete.

Community Building

- Winners of the Meme Campaign were announced April 1 — thank you to all that participated!

- Winners of the Toks.Tech quiz campaign were announced April 4 — thank you to everyone that participated in this as well!

Activities

- Vite’s CMO Luke attended the Innovation Summit at the University of Notre Dame, where he was a speaker in the Blockchain for Government Panel: Socially Meaningful Use Cases and Non-Disruptive Innovation. He presented Vite’s concept of City Coins and partnership with the City of Syracuse and received a lot of positive feedback.

- Vite had its first campus outreach event at Berkeley — stay tuned for more to come (it’s free lunch. You can’t say no to free lunch).

Official: https://www.vite.org/

Vite Forum: https://forum.vite.net

Telegram:

- English: https://t.me/vite_en

- Chinese (中文): https://t.me/vite_zh

- Russian: https://t.me/vite_russian

- Korean: https://t.me/vite_korean

- Vietnamese: https://t.me/vite_vietnamese

- Thai: https://t.me/vite_thai

- Japanese: https://t.me/vite_japanese

- German: https://t.me/vite_german

- Arabic: https://t.me/vite_arabic

Twitter: https://twitter.com/vitelabs

-

ViteX Simulation Trading Competitionposted in Campaigns

We’ve got another contest for everyone! This time, we’re taking it a step up from just placing orders on ViteX. Now, the goal is to grow the your portfolio using virtual trading funds — the account with the highest returns wins! Alternatively, you can also use the VX mining feature (remember, trading is mining).

HOW THIS WORKS

This competition will be from July 12, 12:00 UTC+8 ~ July 24, 24:00 UTC+8-

All trading records on ViteX will be cleared on July 11, prior to the beginning of the event on July 12, 12:00 UTC +8. During this clearing process, transactions cannot be initiated.

-

Until the end of July 24th, users who register on ViteX will receive virtual funds in the amount of 2 BTC and 100,000 VITE to use for the competition. These funds will be available on the day after the user registers. In order for to be considered, all participants must fill out this form.

-

The goal of each participant is to grow the value of their virtual portfolio and/or mine VX via trading. In this contest, only VITE/BTC trading pair will reward VX. Other mining VX function such as staking or market making will not be available. (Updated!)

-

With the exception of the initial virtual funds provided by ViteX, the only way that users can grow their portfolio is by initiating orders. Users will not be allowed to deposit or withdraw any funds to their accounts.

-

Every 3 days during this competition, the ViteX team will post a list of the top 30 traders along with the top 10 VX miners so that users can see their rankings within the pool.

ViteX reserves the right to interpret the event and deal with users who exhibit cheating behaviors accordingly. -

The final rankings will be determined at the end of the contest and results will be announced on July 25.

ViteX reserves the right to interpret the event and deal with users who exhibit cheating behaviors accordingly.

Additional Information:

- After the event is finished, the transaction records and virtual fund balances will be cleared. However, the user information will be retained so that when the ViteX exchange goes live, the participants can use their accounts to trade on ViteX.

AWARDS

Rewards for the Highest Portfolio Returns

As long as an account address initiates at least one buy/sell order, it will be eligible for the contest. All the wallet addresses during the event will be ranked according to the BTC-equivalent value of their holdings (Updated!). For the top traders with the most valuable portfolios:

1st place: 6,000 VITE + 200 VX

2~5th place: 1,000 VITE +50 VX each

6~10th place: 300 VITE + 20 VX each

11~30th place: 100 VITE + 5 VX eachRewards for Top VX Miners

1st place: 3,000 VITE + 200 VX

2~5th place: 1,000 VITE +30 VX each

6~10th place: 300 VITE + 20 VX each

Note: VX rewards will be issued within 2 weeks after the launch of VX mining. VITE rewards will be issued within 7 working days after the end of the competition. The ViteX official team will ask for the VITE wallet address to issue rewards.

Again, all participants must fill out this form so that the ViteX staff can issue virtual funds and any applicable winnings.Happy trading!

-

-

Vite Bi-Weekly Report July 1~15, 2019posted in Bi-Weekly updates

RECENT MILESTONES

- On July 3, Vite Pre-Mainnet launched its first hard fork, nicknamed SEED. The main purpose of this upgrade was to improve the smart contract’s ability to generate unpredictable random numbers.

- On July 5, we added a built-in function allowing developers to upload their DApp smart contract code (as an additional option to uploading it separately onto Github).

- On July 11, we released Android wallet v2.2.1, which now includes cross-chain support for sending and receiving ETH and ERC20 tokens on the Vite chain.

- On July 11, we burned ~3M VITE coins in order to keep the total circulation around 1 billion VITE as we near the Mainnet launch. For more details, please check this article here.

- On July 13, we released iOS wallet v2.4.0. The new version supports ETH and ERC20 token cross-chain deposits and withdrawals and the latest GRIN 2.0.0 hard fork.

SYSTEM DEVELOPMENTS

Go-Vite

The new 2.2.1 version further optimized the node network synchronization logic to improve the efficiency and stability of the ledger synchronization.

Organized quota collection standard.

Designed and developed the dynamic quota schemes.Vite Wallet App

Completed:- Iteration of Android v2.2.0 and v2.2.1. The latest version supports ETH and ERC20 token cross-chain deposits and withdrawals.

- iOS 2.4.0 development was completed. The new version supports ETH and ERC20 token cross-chain deposits and withdrawals as well as the latest GRIN 2.0.0 hard fork.

- The Vite Connect back-end function has been developed and tested.

In Progress:

- Android v2.3.0 Vite Connect development progress 30% complete.

- Android users airdrop analysis and research is in development.

- ViteJS 2.2.5 bug fix. CreateContract was updated.

Block Explorer & Gateway

- The Grin wallet gateway was updated to support the latest Grin 2.0.0 fork.

- The block browser v1.4.0 added new contract code uploads and displays.

ViteX Exchange

Completed:- Staking as mining, trading as mining, user dividend distribution are now ready for the beta version test.

- The ViteX Operator transfer of rights, trading pair listing, and profit distribution functions have been completed and entered the testing phase.

- The referral as mining function has been completed and tested.

- Deep consolidation, push of the latest transaction, order change push, data warehousing function developed and ready for testing.

In Progress:

The review of order-matching mining function has been completed and development is underway.COMMUNITY BUILDING

We had a slew of SBP AMA’s recently! Thank you to the SBPs who led them as well as all those who attended:

- July 2 — Kavin from dragon_vite

- July 8 — Yuqi Jin from Vite NO.1

- July 15— Mr. Dawei from V666.fun

July 12, the ViteX Simulation Trading Contest was launched. Participants will receive initial virtual funds of 2 BTC+100,000 VITE to trade on ViteX. The address with the biggest portfolio returns wins! The first place prize is 6000 VITE+200 VX. The contest ends on July 24, so it’s not too late to register — for details, see our Medium article here.

ACTIVITIES

image url)

image url)- On July 12th, Vite SBP SwissVite representative Jean Luc visited Vite Labs Beijing office and had an in-depth conversation with Vite team. We are looking forward to building the Vite ecosystem together with SwissVite!

-

RE: Vite Android Wallet APP is Online! (and Campaign of Reporting Bugs)posted in Bugs Bounty

My password contains 6 characters, it was created in desktop version. But the application does not accept it and says that the password must contain at least 8 characters

-

Evolution of Decentralized Exchangesposted in Announcements

Evolution of Decentralized Exchanges

By Charles Liu, Vite Labs CEO

OTC — Stone Age of Trading

Digital assets (e.g. Bitcoin) caused unprecedented demand for ways to facilitate trade between people across borders. At first, this demand was fulfilled on social media platforms where asset holders would create posts or send messages within forums in order to discover trading counter-parties.

Commonly known as over-the-counter (OTC) trading, this method presents obvious problems including inefficiency, high risk of default and lack of effective pricing mechanisms.

As blockchain technologies grew in popularity, new digital assets emerged and more individuals entered the market. OTC trading could no longer keep up with this level of demand so exchanges emerged as designated spaces dedicated to trading.

Centralized Exchanges — Industrial Age of Trading

Centralized exchanges (CEX) gained popularity due to the increasing volume of digital assets and traders globally. Exchanges increased the efficiency of markets, since users could now congregate on common platforms to buy and sell orders that were quickly and automatically matched by the exchanges’ computer programs. In addition, exchanges decreased the risk of trader default by locking up the liquidity of counter-parties during trades.

Typically, a user would transfer their digital assets to a centralized exchange before conducting a trade. Their assets would be locked within the system at a predetermined exchange rate. Through a process called “matching,” the system would automatically find orders in the opposite direction and the exchange would conduct settlement of assets between counter-parties. During the matching process, both parties would be prohibited from moving their assets involved in the trade.

Although centralized exchanges were a welcome departure from OTC trading, they came with their own set of risks and flaws.

Security — Fundamental Flaw of Centralized Exchanges

Although centralized exchanges increased trade efficiency, eliminated default risk and provided an effective pricing mechanism, these benefits came with a price.

In order to ensure trade execution, centralized exchanges require users to deposit their assets. As such, these exchanges gained custody over a tremendous amount of assets, giving rise to serious security concerns. Users have to accept the risk that their exchange-held assets may be stolen and that these assets may be mismanaged by the exchanges. Meanwhile, exchanges must remain vigilant against potential hackers.

Ultimately, since assets go through a centralized authority, whenever an exchange is compromised, it is impossible to tell if stolen assets were looted by external hackers, misappropriated by the exchange or removed by exchange employees themselves.

Although exchange thefts are unlikely, to control security risks and asset misappropriation, exchanges impose restrictions on user redemptions (removing one’s money from an exchange). Any user of a centralized exchange knows that deposits are free and convenient, whereas redemptions involve many constraints (e.g. maximum redemption amounts, long processing times, manual verification requirements).

Monopoly — Original Sin of Centralized Exchanges

From a commercial perspective, centralized exchanges compete as individual corporate entities seeking profit maximization. Once an exchange becomes a monopoly, they exploit their position and charge exorbitant fees from projects looking to list on their exchange. This behavior threatens fair competition in the marketplace of digital assets, increasing both risks and costs for traders.

Many excellent projects in blockchain are organized around open communities, which often lack the capital to pay expensive listing fees. In contrast, mediocre projects that fundraise are able to pay these fees (sometimes over 50% of their fundraise) and use remaining funds for market manipulation to inflate their coin prices.

This kind of corrupt collaboration between exchanges and disreputable projects pose a serious risk for coin buyers, since these projects have neither the financial stability nor the technical capacity to achieve long term success. The result is a vicious cycle where bad coins simply crowd out good coins. This vicious cycle builds bubbles within digital asset markets, threatening the health of the entire blockchain industry.

Therefore, a coin buyer has a love-hate relationship with centralized exchanges. To summarize, here are the pain points for users:

- Lack of security of digital assets

- Bad user experience especially with registration and redemption

- No diversification of options since trading is limited to coins listed by the exchange

- Intransparent governance in rule-setting, listing fee remittance and matching logic

Decentralized Exchanges — Information Age of Trading

Decentralized exchanges (DEX) entered the spotlight due to problems associated with centralized exchanges.

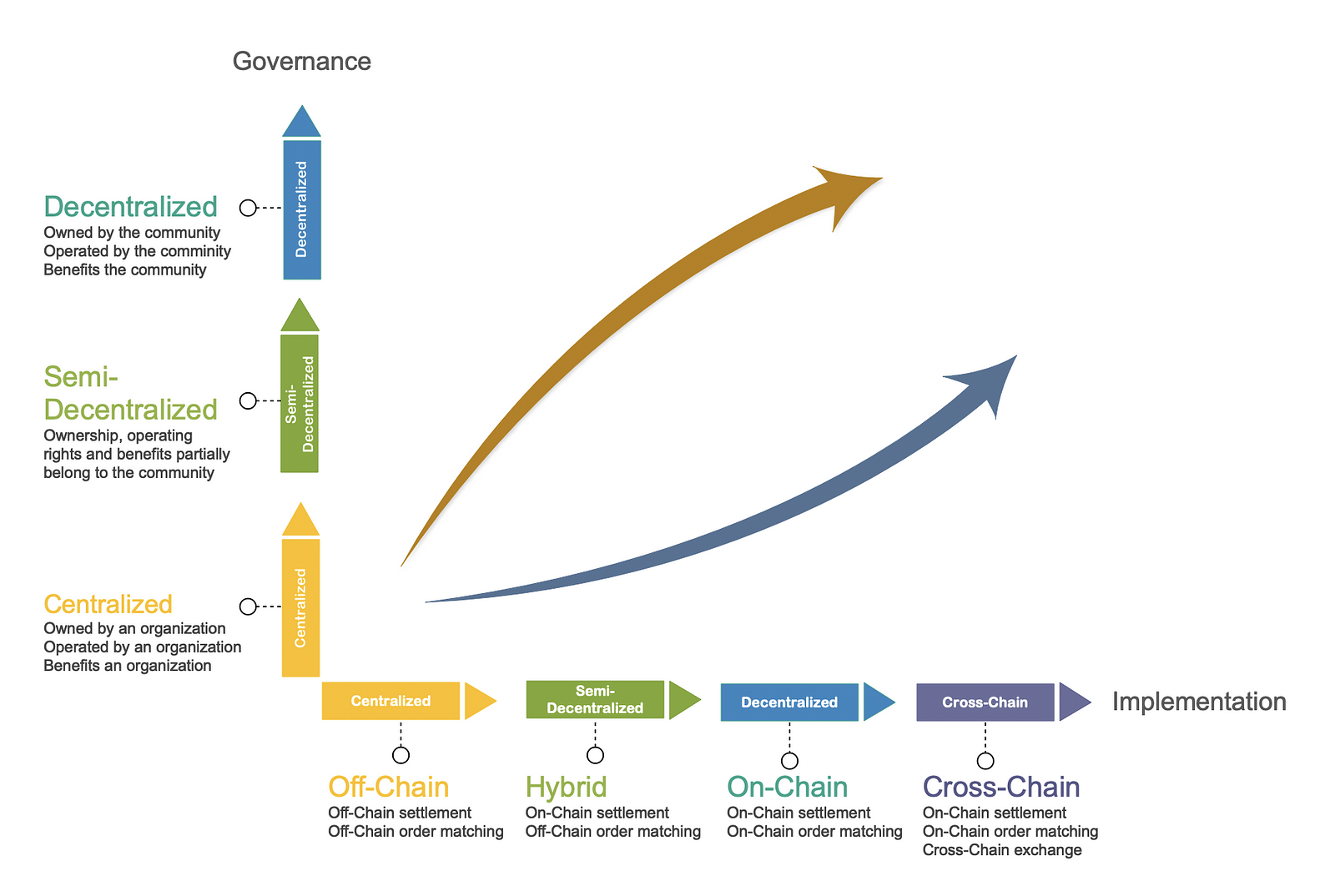

The difference between centralization and decentralization can be summarized from a technology angle and from a governance angle.

In terms of technology, a decentralized exchange is a decentralized application (dApp) created on a public blockchain. Trustlessness and immutability are achieved through smart contracts.

In terms of governance, a decentralized exchange is open and driven by community participation; responsibilities are distributed within the community in a decentralized way.

In reality, many decentralized exchanges have been unable to achieve true decentralization from both angles. They either use centralized technologies and allow community participation in governance, or use decentralized technologies while keeping a centralized commercial and governance model.

So, what does a true decentralized exchange look like? What benefits can it offer users?

On-Chain and Cross-Chain — Decentralization from a Technology Angle

The technical stack of an exchange consists of two modules: 1) asset management 2) order matching. The former provides data storage, asset custody and trade settlement. The latter saves order book data and performs order matching.

A truly decentralized technology implements both modules with on-chain smart contracts. Users’ assets are held by smart contracts to safeguard against theft and misappropriation. Users freely redeem their assets without lengthy and complicated redemption processes. Order matching logic is dictated by smart contracts, which removes the risk of cheating behavior such as front-running.

Thanks to the advantages of blockchain, decentralized exchanges enjoy high uptime. At nearly any moment, a node is ready to provide services, hence guaranteeing the continuation of order matching and trade settlement. In the worst case scenario, a user can choose to run a node themselves in order to continue a disrupted trade and securely transfer assets to their wallet.

A completely decentralized solution requires strong performance from the underlying public blockchain alongside low cost of smart contract execution. To date, most public blockchains cannot meet both requirements. Many decentralized exchanges make the tradeoff by utilizing Layer 2 protocols to move low-frequency asset management modules on-chain while keeping high-frequency asset management modules off-chain. Although these solutions solve pressing asset safety issues through decentralization, the off-chain order matching logic reduces the extent of decentralization and subsequently increases the cost of developing and operating the decentralized exchange.

Lastly, the ability to support trading of many different assets (a.k.a. cross-chain) is another key differentiator for decentralized exchanges.

Ownership, Operation, Income Sharing — Decentralization from a Governance Angle

From a governance perspective, in a decentralized exchange, the rights of ownership, operations and income sharing belong to an open community rather than a single entity.

A centralized exchange determines trading hours and can freely change the rules of trading. The organizing entity decides who can trade and what they can trade. Value generated from trading belongs to the entity as income.

A decentralized exchange does not place ownership in the hands of one entity. All changes of trading rules are determined by consensus, via community voting or forking. The decentralized exchange does not select its users nor its trading pairs. The right to set trading fees belongs to the community. Similarly, value generated in a decentralized exchange is income for members of the community.

To date, both centralized and decentralized exchanges have launched some form of platform coin. Based on the economic model of these coins, one can clearly see the governance models of the exchanges.

If the platform coin exists mainly to offset transaction fees (with no other rights like voting power), then the coin is akin to a coupon or rebate. In this case, there is a centralized entity responsible for minting these platform coins for which holders are merely consumers who receive discounts.

Consider an alternative model in which the overwhelming majority of platform coins are owned by the community, which has the power to make decisions regarding exchange operations and is entitled to receive future proceeds from the exchange. In this case, the governance model is decentralized; by empowering the community to share in value generated by the exchange, users are incentivized to perpetuate the marketplace, which ultimately lowers transaction costs for traders.

Consider another feature in which the protocol of the decentralized exchange is made available to other exchange operators in order to increase liquidity. From a unified technology framework, all traders share a deeper order book, so rising tides lift all ships.

Path of DEX Evolution

The diagram shows the evolution of exchanges from the aforementioned two perspectives. The path to decentralization takes two different trajectories yet they both begin with centralized governance and technology, ending with decentralized governance and technology.

The evolution of exchanges

The evolution of exchangesChallenges

Many traders still prefer centralized exchanges over decentralized exchanges, which is understandable. Decentralized exchanges trail behind centralized exchanges in terms of user experience, with the biggest issues being 1) slow order matching 2) high transaction costs 3) insufficient liquidity. No user should tolerate trading confirmation times longer than 10 seconds or having to remit high fees for transaction cancellations. In short, users need the ability to quickly buy and sell digital assets at a low cost.

From a technology perspective, decentralized exchanges must solve for speed and cost. Such challenges are directly correlated to the performance of the underlying public chain. For this reason, many decentralized exchanges have opted to develop their own public blockchain.

Due to the differences in protocols, ledgers and consensus algorithms between public chains, solving the cross-chain liquidity problem of digital assets is a huge challenge. Although there are many cross-chain solutions, none have perfectly addressed this challenge.

Currently, the most viable option for decentralized exchanges to solve this issue is based on a cross-chain approach to notary, which is called “gateway.” The weakness of this model is its reliance on off-chain trust; this reliance prohibits true decentralization. Even if a mechanism for supervising, prioritizing and forming true consensus among different notaries exists, there is a possibility that the notary conspires to manipulate the system.

Another solution for cross-chain liquidity is the atomic swap. The atomic swap model is a peer-to-peer exchange of assets between different public chains, as opposed to a unidirectional asset transfer across the public chain. For example, to trade Bitcoin or Ethereum, one must find a counter-party willing to surrender a corresponding amount of ETH in exchange for BTC. Then, the ETH transfers to one’s wallet while one’s BTC is transferred to the counter-party’s wallet. In this way, the atomic swap is most suitable for OTC transactions but cannot satisfy on-chain order matching.

There is also a type of “isomorphic cross-chain” solution, used by projects like Cosmos and Polkadot, to improve interoperability between chains with existing protocols by designing a higher level protocol. The problem is that they cannot achieve “cross-chaining” between existing public chains, unless mainstream public chains such as Bitcoin and Ethereum are compatible with such higher level protocols. In the short term, this is a difficult reality to achieve because the cross-chain problem lies in the cross-protocol interaction and competition between public chains is essentially the competition between protocols. Therefore, accomplishing the goal of “cross-chaining” through a unified protocol is incredibly difficult.

Decentralized exchanges must provide sufficient liquidity incentives, which rely primarily on proper governance and incentive models. This requirement is often overlooked and it is the greatest shortcoming of current decentralized exchanges.

Strictly speaking, an exchange with decentralized technology and centralized governance should not be called a decentralized exchange. The decentralization of governance is far more difficult than the decentralization of technology. Whether it is the design of economic models, the establishment of communities or the development of trading ecosystems, full decentralization is a long process wherein traders, traditional exchanges, projects, market makers and crypto investors attempt to achieve a stable environment through ongoing competition and collaboration.

Therefore, a truly decentralized exchange should focus on building a complete trading ecosystem, coagulating the liquidity that was originally dispersed in different “centers” rather than trying to become a new “center.” This is the true meaning of decentralization.

Destination of DEX Evolution — Completely Decentralized Exchange

As public chains and governance models improve across the blockchain industry, all necessary pieces are available to build a commercially viable fully decentralized exchange. Users from traders to enthusiasts are looking forward to a new generation of digital asset exchanges that are decentralized from technology to governance. Vite Labs presents ViteX (Vite DEX), a product that brings us one step closer to the ideal.

- The exchange should be built on a high-performance, low-cost public chain with on-chain order matching and cross-chain capabilities.

- The exchange should have a fully open ecosystem that not only benefits the community, but rather, is “by the community for the community.”

- The governance model should benefit all participants within the ecosystem whether they are traders, operators, liquidity providers or blockchain projects.

ViteX is a decentralized exchange with a user experience on par with centralized exchanges. Assets are controlled by the user’s own private key and do not require complicated registration processes.

ViteX is an open platform that anyone can use to open their own trading zone as easily as opening a store on eBay.

The main role of ViteX operators is the “DEX operator,” which is similar to being an eBay store owner. These operators could be from centralized exchanges, blockchain projects, token funds or community leadership circles. Operators have their own trading zones and retain their own brands. They have the right to list trading pairs, set transaction fees and more. The operators’ brands and credits are critical to their success. For example, operators with strict listing standards and due diligence processes may be more likely to be promoted by users.

ViteX provides the infrastructure for community operated exchanges including smart contracts, websites, application programming interfaces (API) and software development kits (SDK). Operators either build their own websites based on the ViteX API or they connect with their own trading systems.

ViteX provides community incentives and decentralization through the VX platform token. There is no pre-sale nor pre-mining for VX, which ensures an equal playing field for all users. VX can be obtained through completing a transaction, opening a new trading pair, providing quotas for ViteX smart contracts, providing liquidity to ViteX, inviting new users and more. These rules are to be written into the smart contract as part of the protocol.

The ViteX platform is owned by VX holders and any changes to the protocols and rules must go through a voting process of VX holders. 100% of profits generated by ViteX will be distributed back to VX holders in proportion to their VX holdings.

ViteX is built on the Vite public chain. Vite is an asynchronous high performance public chain with smart contract capability, based on DAG ledger with Hierarchical Consensus mechanism. Transactions confirm within a second and there are no transaction fees. Vite offers multi-token support and cross-chain assets. Vite is designed for use cases like decentralized exchanges, which mandate a certain level of performance and stability.

Our intent is for ViteX to serve as a model that accelerates the evolution of decentralized exchanges across the industry. This movement would generate more business opportunities and bring prosperity to the digital asset ecosystem and to cryptocurrency traders.

Latest posts made by Oleg

-

RE: Vite Developer Committeeposted in Tech

DECLARATION OF CANDIDACY

Name:

Oleg

Discord username:

Oleg#3520

Telegram username:

@OlegEnthusiast

How long you've been with Vite community:

2.5 years

Why you are interested in becoming a member of the Vite Developer Committee:

I always try to help the Vite as much as I can

What contribution you will be able to bring to this committee:

Everything related to the community and its development

Other information about you (Optional, such as example ideas of new projects to build on Vite, or your past involvement in tech):

Not to strong in dev, but I understand the technology well and how everything works, I can tell what is most relevant for development at the moment. -

ViteX One-Year Anniversary Dual Campaign Winnersposted in Campaigns

List of winners:

vite_4d0109 ********** f99070ac

vite_873f5a ********** b4f7e2ab

vite_2edbfa ********** d91a0e9e

vite_df68ad ********** 45b4715f

vite_27e434 ********** 8a96528e

vite_1a6926 ********** b5f2946eDear winners,

In order to receive the rewards, write me a personal message on Twitter (https://twitter.com/OlegEnthusiast) with your full vite_address. Also you should make a retweet of this https://twitter.com/vitexexchange/status/1314338396085473280?s=21, with your thoughts about ViteX and tag at least three contacts on twitter. The one, whose retweet gets the most likes will receive a T-shirt from us as a souvenir

.

.Thank you all for participating!

-

Vite Techie Club #1posted in Vite Techie Forum

Dear Community,

Vite is two years old now. Thanks for your accompany and support so far. Since Vite’s earliest days, we have developed a reputation for our strength and innovation in tech. We have been asked so many times by enthusiastic community members and developers to participate in the tech discussions with Vite core devs, so they can contribute great ideas and even write code. As such, we are pleased to announce the launch of Vite Techie Forum, a series of regularly-held, text-based online discussion events, where we invite all technocrats to incubate Vite’s future plans!

We present to your attention a recap of the debut Techie Forum event in which you can meet our developers and learn about plans for the development of the gateway structure. Enjoy!

Allen at 3:00 PM

Today will be our first hangout for Vite Techies and the community! I am glad to announce the kick-off of the Vite Techie Forum event series.

It will be a platform for Vite Techies and the community to exchange ideas and conduct technical discussions with the Vite core dev team.

The topic today is the decentralization of ViteX gateway, a frequently asked question concerned by many Vite and ViteX users.

We are glad to invite two core dev members, Viteshan and Wills Lee, to join the discussion.Allen at 3:03 PM

Allow me to introduce them now

Willis is the architect of ViteX. He led the design and implementation of the ViteX smart contract and related components. He wrote the ViteX explained tech article series on Medium.weichaolee at 3:03 PM

Thanks @Allen , Welcome everyone to discuss something about ViteX gateway evolutionAllen at 3:05 PM

Viteshan is a talented full-stack engineer, a key contributor to Vite's protocol, and the architect of the Vite public chain. He is driving the scheme design of Vite 2.0. Shoot him questions if you would like to know more about the everything of Vite.

Allen at 3:07 PM

Over the weekend I've sent out a deck. I hope you went it through.

In the deck, I simply introduced the background, current solution of ViteX gateway, and a proposed plan (mainly raised by the team ).

Today, we are going to talk about the decentralization of gateway first

then we will go through the proposal. We are also open to other plans, so chime in if you have something cool for us. lol

Let me shoot some questions to Willis and viteshan.So, Willis, what do you think about the decentralization of exchange gateway, do you think it is necessary?

weichaolee at 3:13 PM

I absolutely believe it's very necessary for gateway to be decentralized. gateway decentralization will make assets more secure and transparent, just like what we have done in ViteXAllen at 3:15 PM

@viteshan also please share your thoughtsviteshan at 3:15 PM

yeah the goal of VITEX is the largest and most convenient DEX.

However, the current solution cannot allow all tokens to be traded freely in VITEX.

Whether it is the token on ETH or the token on TRON. We need to improve our agreement so that any token on any chain can join freely in the VITEX exchange.Allen at 3:16 PM

As the fully decentralized exchange, some users have asked about the gateway, is it decentralized too? So I think this will be our answer

We will set up a decentralized gateway plan in ViteX gateway 2.0. It will be secure, convenient, and fully decentralized.

Ok the 2nd question

@viteshan @weichaolee can you briefly introduce the well-known decentralization schemes for gateways, their pros and cons, and why you finally choose this one?viteshan at 3:19 PM

In general, there are three schemes for cross-chain gateways.

The first is Notary. In this scheme, a (or several) notaries are responsible for verifying transactions on both chains and then operate the gateway account to transfer the counterpart token to the user.

Notaries are easy to implement, the gateway in ViteX Gateway 1.0 takes notary scheme.

The second method is the side chain. In this solution, an independent chain is usually used to store and verify transactions on the original chain.

The verification of cross-chain transactions is written into the side chain and must be confirmed by all the nodes, usually through smart contracts.

The benefit of this mode is the transactions are more transparent and gateway confirmations are more reliable, but the setback is the side chain is more complicated and takes time to implement.

Atomic swap (HTLC) is widely used in scenarios where two users need to swap their tokens into another.

The atomic swap is settled at a fixed, negotiated price before the deal is made.

It often relies on the users happen to have the demand to swap, otherwise, the deal may not be complete in time.

So usability/liquidity will be the biggest problem because you are "swapping" with another guy.Allen at 3:27 PM

Thanks

Very detailed explanation

@weichaolee what's your opinion here?

can you share some insight with our community?weichaolee at 3:29 PM

The tradeoff also is very important for any solution for concrete implementation so will combine former solutions as our final solution.Allen at 3:30 PM

Thanks Willis

Now I will leave 5 mins for Vite Techies and our community to bring their ideas or questions.

Crypto Bear at 3:31 PM

Does ViteX gateway 2.0 apply to all ViteX Operators? If so then they no longer need to set up a gateway...etc?weichaolee at 3:32 PM

@Crypto Bear It will be an open gateway framework applicable to all operators, When an operator lists a new coin, he should implement the necessary gateway features (deposit/withdrawal/contract, etc.)stone at 3:32 PM

@weichaolee since they will no longer hold funds or control, in case any issues, then who's responsible?weichaolee at 3:34 PM

@stone The funds will be stored in a smart contract deployed by the operator. The decentralization relies on how many witnesses the smart contract designates.

The witnesses as well as the operator are responsible for any loss or misappropriation of the funds. If the loss comes from a defect in the smart contract, the owner of the smart contract will be responsible.stone at 3:35 PM

@weichaolee is it related to the number of Supernode of the whole network?weichaolee at 3:37 PM

The witnesses as well as the operator are responsible for any loss or misappropriation of the funds. If the loss comes from a defect in the smart contract, the owner of the smart contract will be responsible. more detailed solutions need be involved in our decentralized gateway roadmapstone at 3:40 PM

@weichaolee

Which means the anonymous Operator still exists and users still need to choose the trusted Operator to deposit their coins instead of choosing a random Operator?weichaolee at 3:42 PM

@stone witness does not equal to Supernode, a witness is a designated address, that somehow granted the right for approving tx that broadcasted by the operator

users no need to trust the operator, the deposit/withdraw process will be confirmed decentralized by witnessesBob6768 at 3:32 PM

I remember you guys had a DDoS recently, so how does the new gateway prevent DDoS attack?viteshan at 3:35 PM

@Bob6768 In general DDoS is not much related to the detailed technical implementation of the gateway.

it's more about how you deploy the services and API endpoints on the network so they can recognize malicious visits and then block them.

And to answer your question - yes the new gateway will be fully available under DDoS attacks. In fact, the last DDoS did not affect the vitex gateway.super at 3:34 PM

I have an idea regarding listings on VITEX. For the moment it is needed an operator to do this job but what if we have a system in which every listing is decided by VX holders? Example: VITE team will conduct a poll in which an amount of tokens will be available to be listed. VX holders will vote for the coin which they want to be listed. Everything will be in the wallet and on-chain. This way there will be no need for centralized operators anymore and more coins will be available on vitex.viteshan at 3:39 PM

@super Exactly. New listing from voting by VX holders will be part of the decentralized governance of ViteX 2.0.

We will set up a voting contract in the new ViteX model, so everyone having VX (above the minimum threshold) will have a chance to vote.Allen at 3:40 PM

Cool. Thanks guys for the questions and the answers. Very hot discussion. Now let's take a closer look at the proposal. Let me paste some content from the deck here.

This is the deposit process of the new decentralized gateway proposal

you guys can see the solution is based on Witness + Multisig + Smart Contract / P2SH

Original/mapped assets are stored in gateway smart contracts

Witnesses verify deposit/withdrawal on both chains and submit confirmation to the gateway smart contract.

Deposit/withdrawal will be marked complete when M/N witnesses confirm in the contract

To become a witness, a certain amount of VITE and(or) VX should be staked. Witnesses can benefit from verification rewards. The misbehaved witness will be slashed.

Mapped assets are issued/burned in contract on actual deposit/withdrawal requests.

So this is the general design concept of the proposal

Let's take a look at the deposit process now.viteshan at 3:45 PM

staking is very important.Allen at 3:45 PM

In this sequence diagram, we have 3 smart contracts deployed: two gateway contract deployed on Vite and Ethereum, and one token issuance contract on Vite.

Step 1. A user requests for deposit address at the Vite gateway contract;

2. the gateway contract bind the deposit address to Vite address and return it;

3. The user deposits ETH to the deposit address on Ethereum;

4. Witnesses start to verify the deposit on Ethereum;

5. Witnesses submit confirmations to the Vite gateway contract;

6. deposit is confirmed when M/N witnesses confirmed. The signatures must be verified in the contract;

7. The contract mints the equivalent amount of ETH-000 and sends them to the user.

So this is the deposit process in the new gatewayLet's take a look at the withdrawal

- A user requests for withdrawal and sends ETH-000 to the Vite gateway contract;

- Witnesses start to verify withdrawal on Vite;

- Witnesses submit confirmations to the Ethereum gateway contract;

- Withdrawal is confirmed when M/N witnesses confirmed. The signatures must be verified in the contract;

- The contract sends ETH to the user;

- Witnesses confirm withdrawal complete (attach tx hash) in the Vite gateway contract;

- The user confirms withdrawal complete (or auto-confirm after a timeout period is passed);

- The contract burns the equivalent amount of ETH-000.

That's all for withdrawal

Guys, I've briefly introduced the concept design, processes of deposit/ withdrawal in the new gateway proposal.

I am sure you must have questions

I will leave about 20 mins for open discussion now

I restate again: we are open to all proposals lol

stone at 3:56 PM

what about the existing gateway like VGATE and Bi23? will they automatically migrate to the new version gateway?weichaolee at 3:57 PM

@stone They will migrate, but not automatically. The ViteX gateway 2.0 is a new framework, and it's open-sourced.

VGATE and Bi23 should expand the framework by plugging in the coins they operate, designate the witnesses, then deploy the service on their gateway servers.stone at 3:59 PM

@weichaolee is it compulsory or not for them to upgrade?

And next question: if my witness node stops working, will I be slashed? and how does it happen?weichaolee at 4:00 PM

VGATE and Bi23 will play an operator role in our new gateway ecology, and witness will be introduced as a separate rolestone at 4:02 PM

@weichaolee do you mean they need to build another thing (witness) besides the task of being an Operator?weichaolee at 4:04 PM

@stone They can remain current centralized version gateway service, but strongly not suggested

@stone Since the gateway smart contract needs to collect enough confirmations to proceed with a deposit/withdrawal request if your node stops working and causes the contract cannot receive the minimum confirmation. Anyone from the community can fill a dispute. The committee will judge according to the records on-chain. In this case, your staking deposit will be slashed.stone at 4:04 PM

@weichaolee got it! You need to change if everyone is changing to adaptCrypto Bear at 3:59 PM

how to run a witness node?viteshan at 4:02 PM

@Crypto Bear This is a good question. Basically, as a way to guarantee the new gateway framework performs in order, at the beginning we would like to restrict the witness to a fixed number, and a committee led by Vite Foundation will vote to choose the first group of witnesses.

A new witness is allowed to join only when someone quit. When the start-up period is over, anyone can apply to become a witness.

Periodically, VX holders will vote for the next batch of witnesses in a smart contract. This is part of the on-chain governance of ViteX.

However, the details are still to be outlined.Bob6768 at 4:01 PM

Also regarding the Witness Node, will there be rewards to run it?Daniel Leedan at 4:01 PM

Thanks for the detailed explanation, I'm glad to see that the team understand that change is needed to make Vitex truly decentralized. I think your proposal is good, it sounds interesting and doable. I'd like to hear what are the difficulties of your proposal.Allen at 4:08 PM

@Daniel Leedan In the first stage of implementation, Vite Foundation is supposed to lead a committee for the selection of witnesses. The total number of the witness must be fixed and designated by the committee in a form of voting. I would call this as a cold start. When this phrase is over, the selection will be open to every VX holders in a smart contract. Anyone can run a witness node. So I think in the cold start stage we may have to tackle some governance issues.slimcan at 4:01 PM

I'm sure we all have some thoughts about Ethereum gas prices. For withdrawal, when witnesses submit confirmation to Ethereum smart contract, how will the witnesses be paid or compensated for gas?viteshan at 4:10 PM

@slimcan This gas cost needs to be paid by the node. there are rewards to run a witness node. In order to calculate the cost more easily, perhaps a gas station is an alternative solution.OKtamak at 4:05 PM

Will there be a chance for the existing full node operators to become witness operators?Allen at 4:10 PM

Of course. By staking a certain amount of VITE or VX you will get the chance but remember you also need to be selected to be one.

At the early stage, we will assign a committee but later this process will be fully open to everyone voting in a smart contract

@OKtamakOleg at 4:09 PM

I would also clarify: Why not atomic swap?viteshan at 4:11 PM

@Oleg the atomic swap is more suitable for between two valuable tokens, such as ETH and VITE, rather than ETH and ETH-000.

Both parties to the atomic swap have the right to choose to refuse the swap.

But in this case, the gateway must provide the service of converting ETH-000 into ETH. The value of ETH-000 can be exchanged for ETH. So we did not choose the atomic swap.Allen at 4:14 PM

Thanks @viteshan

Hey guys. Thanks for coming to today's discussion. I scheduled for 1 hour but too many hot discussion lol

I am going to close the discussion for now

Thanks for attending this Vite Techie forum

I am sure you may still have some questions. For anyone still has questions you can drop them here, and the Vite dev team will answer them later

See you all in the next Vite Techie Forum event. -

RE: Vite twitter presence?posted in Community Collaborations

@pangolin MainNet was launched in 2019.

-

RE: Just published a Vite overview article, feedback?posted in About Vite

@pangolin Hi! Thanks for the article, but our MainNet was launched in 2019

-

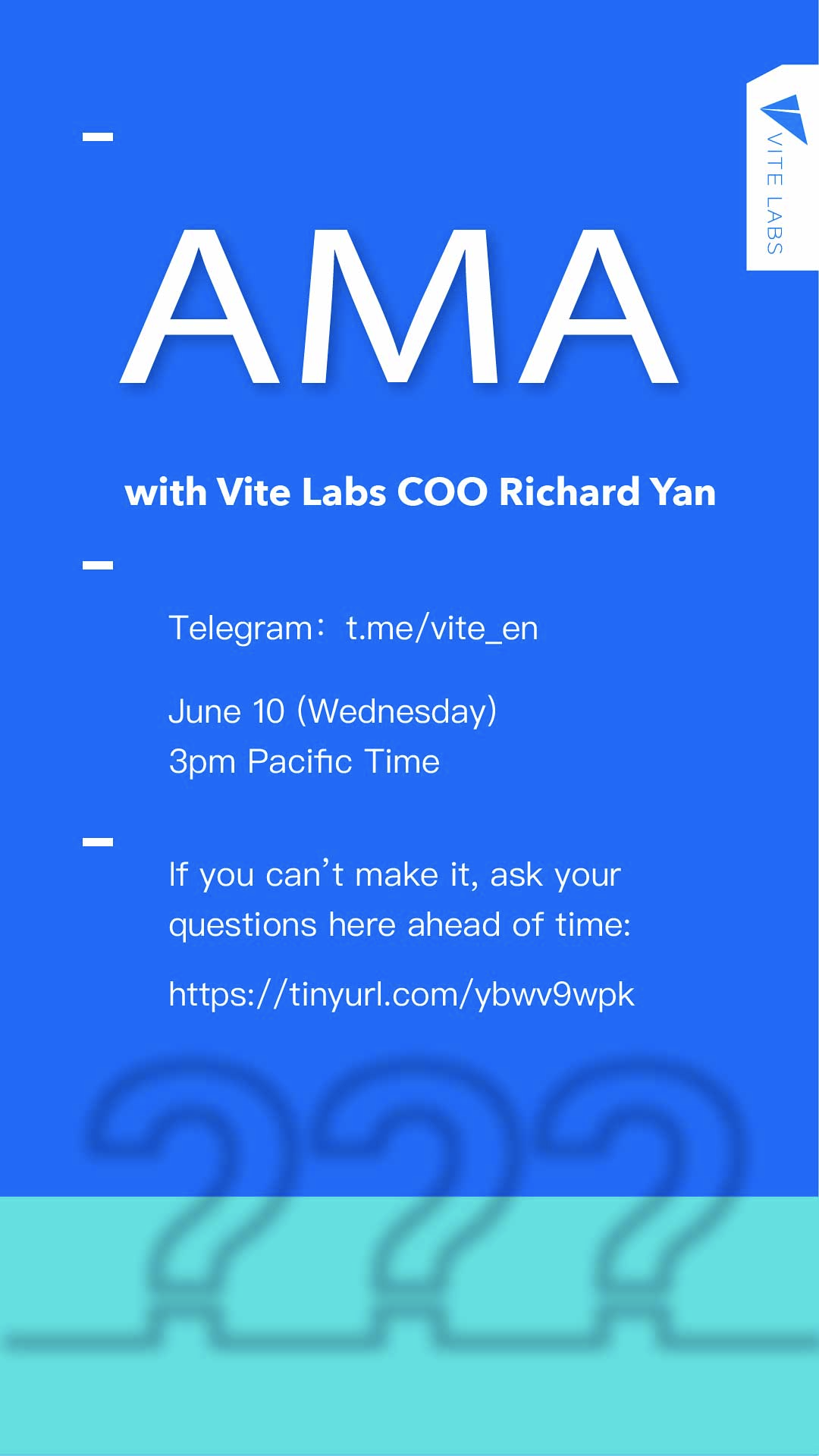

Vite Labs Leadership AMA (July 10, 2020) Reviewposted in AMA (Ask Me Anything)

This is a review of the regular Vite Community AMA, which is held by the head team every 3-4 weeks.

Richard Yan (Vite COO)

Hi all!Richard Yan (Vite COO)

Welcome to the AMAMD : Kawsar Chowdhury

Question : what's the Vite best achievement success story in 2020 year ?Richard Yan (Vite COO)

Based on community feedback and internal review, our main focus will be on ViteX. So this will include listing VX on exchanges and listing coins on ViteXRichard Yan (Vite COO)

We will have a new coin listing on ViteX within a week or soRichard Yan (Vite COO)

In terms of listing VX on exchanges, we are in talks with many big names (perhaps all the big ones you can think of outside the US) - it comes down to a matter of listing fees negotiation. I know this is the same update as before, but unfortunately these price discussions take a whileQuestion from the forum:

when the chainlink implementation will be done?

when futures?

will we see anytime soon an investment in a real marketing campaing done y real marketing professionals to attract more traders?

the website is still old version, what happened?

which of the ideas from community are going to be implemented?Richard Yan (Vite COO)

Most of these questions are answered by our CEO's latest letter: https://medium.com/vitelabs/vite-roadmap-review-and-adjustments-e14592c15ae4Richard Yan (Vite COO)

But let me give some quick bullet points here:Futures - this is not part of 2020 plan now, but afterwards. This involves serious design and liquidity ramp-up, which we are not prepared to handle at the moment.

Real marketing - this comes back to coin listing, which frankly was slow on ViteX earlier this year. We are picking up the pace.

Also - we are releasing the community coin-listing competition campaign within 24 hours

We have created a small group of coin scouts within our team. They've been contributing excellent ideas for listing new coins

According to our plan, the new website will be released within 30 days

In terms of ideas to implement from the community - see the roadmap letter above. Many new additions to the roadmap are DEX-centric

**Responce on the recent suggestions **

Hi Richard, recently "Ultrapower - use 1801183244" offered us some ideas, I think they are worthy of your attention. Please review them carefully. Also to some of ideas I added my comments.

-The current situation needs a correction, VX needs to be used for something else to attract people to buy it, if we simply list it on binance it will just pump and dump if not worse, we need to attract people to do something with it that is not only staking, something that attracts people to trade on ViteX

The exchange like binance, kucoin, crypto.com and others are continuosly hammering the crypto scene with contests, new services, lending, futures and why? because their trading fees are less and less because of competition maybe or less people trading in general? i don’t know the truth but i know that when some business is marketing so much i smell fish, it means it is not going as foreseen, we have an exceptional product on vitex, you can do whatever you want with no KYC, move funds at the speed of light with no fees, we need applications, we need developers loving the lattice smart contract platform that Vite is and developing useful and good Dapps.

DEFI is amazing, on ETH platform is expensive to make smart contracts transactions, we would suck a large slice of the market with our feeles, ligh-fast lattice system.The funds on DEFI on ethereum, where a 14 years old can steal everything in 5 minutes, reached almost 2 billions.

I think the best idea to would be this: double or triple the daily dividends and then market it immediately to create a hype effect, we can even do it for a limited amount of time like: who has 1000 VX gets double dividends for a month or something like this.

And added to that who has 10000 VX for example staked, get’s a card to use everywhere with a % cashback for every tx on shops, we could even do a partnership with some product brand or supermarket and give away vite or vx with some kind of products on the shelf, like, you buy coca-cola you get 10 vite with a code, you buy a computer you get 1000 vite

Can we make ref codes free again ?

Why don’t we create a program with points to get prizes like iphones, macbooks et cetera? when you trade a volume of 10.000.000$ you get a iphone. but what you people should try to understand, is the shininess of it, if you promise a ledger you attract a certain kind of people, if you promise a car you get serious traders, market movers

You buy bids to do on very expensive items like macbooks iphones et cetera and for every bid the price goes up but with VITE super action auctions, the price goes down, the person buying get’s the iphone and some money and all the rest of people paid for it buying bids, it’s like a lottery

Everyday extraction lottery for VX holders, more VX staked better the prize

Hiring a real graphic designer and rebrand VITE in a way it does look not a project like the others.

Richard Yan (Vite COO)

Unfortunately the answer to the point about "using VX" is still to bootstrap liquidity. Coin listing and co-marketing activities as part of that are still the strategy.

Admittedly we've been a bit slow in listing new coins at the earlier part of the year, but we're rectifying that now.

A new listing is happening within a week or so, and the community coin listing competition will launch within 24 hours.

Re: getting devs to make dapps, we will have grants available for dev proposals, as outlined in Charles' letter on roadmap adjustments. But I personally think there's more to do on the DEX side than non-speculation Dapps. The most successful and perhaps the only really useful dapps right now belong to the speculation category. So it's better to focus more on continuing to develop the ecosystem around our DEX. Now that is not to say we won't encourage 3rd party development of other dapps.

We discussed DeFi in the latest ViFi survey response article.

Regarding increasing VX rewards, I am not convinced this will increase true liquidity. But maybe we will look into increasing incentives for market-making as mining. Also, I think listing of new coins and co-marketing around that is the ultimate crwod-attracting campaign.

Plastic cards involve significant logistics. This is more of a longer term project.

About referral codes, we had plans to launch another round of activities to temporarily reimburse the fees for creating codes. Let me check how that campaign is going.

Tangible prizes like iPhones is a good idea. We will consider this. To make shipping easier, maybe Apple discount card?

Bitcoinman

Why there is no effort at promoting Binance trading campaign? No marketing effort from Binance and Vite. No results or Volume increase from that campaign.Richard Yan (Vite COO

Some of these questions are answered in the roadmap update letter Charles sent.More ViteX campaigns is a good idea. Co-marketing for coin listings should have similar effect.

In terms of marketing - note we are having panel discussion with Binance and AMA with Chainlink, both happening within 1-2 weeks.

In terms of getting a credit card - there are many logistical steps to sort out.

We are talking to some vendors about fiat on-ramp though.

So i got the following questions:

Question from the forum

Community members offered some good ideas in which replies were "passed to the team". Do the team really consider those suggestions ? Personally, i didn't saw any suggestion to be included in any release.

We need more coins, more operators, more volume otherwise VITEX will have an unwanted faith - that of being closed because costs of keeping it up will be more than it will be afforded.Richard Yan (Vite COO)

Of course some community suggestions have been incorporated. One example is the stablecoin zero fee conversion feature. This should be out in a few weeks (this requires making sure enough SBPs hard fork - hence a longer process - nature of developing decentralized systems).Another example is interface change to the wallet (using memo instead of comment to make sending to Binance easier, for instance).

Yet another example is display of VX mining statistics to vitex.net dashboard.

And someone suggested adding a ViteX listing google form, which we will add early next week.

Not every suggestion can be incorporated, or incorporated in time. @Daniel_Leedan made many great suggestions (including some about making our github more friendly to developers) - I have asked our team to look into them. But there's also an internal priority of things to be done.

Behind the scenes, we recently did significant refactoring of code to tackle tech debt, and also dealt with upgrading security of our gateway and web services.

Unfortunately such efforts aren't as visible to the community.

Question from the forum

How to get ETH developers to come to Vite.

Richard Yan (Vite COO)

There are many public blockchains trying to do the same thing. I think a smarter strategy is to focus attention on DEX now, which has natural usage and indeed drawn significant interest. I made some other points about how to grow our DEX earlierMarl

how many devs are working on the team currently ?Richard Yan (Vite COO)

We have about 10 full-timers. On top of that, we have testers, designers, product managers. And in addition to these, we have interns and part-timers.Richard Yan (Vite COO)

The coronovirus pandemic was a bit of a turning point. During that time, productivity took a hit, and we evaluated the team output accordingly. Then we made a decision to conserve capital by retaining the most effective developers.Marl

and what's the total number of employees ?Richard Yan (Vite COO)

The total number came down a bit because of the changes I mentioned earlier. But that said, we added many part timers and consultants not currently on our page. Some part timers have day jobs elsewhere and do not wish to appear in public. One example is our business development manager Morgan Jones in New York City. He has been instrumental in introducing Vite to the New York state assemblymember Ron Kim. He's interested in making a "Libra" for the City of New York and we've been talking maybe once a month.Other examples are service reps for ViteX who also do bizdev and coin scouting for the DEX.

Daniel

Hi Richard, I have 2 questions:-

At AMA about a month ago, you mentioned that 5 staff members are working on marketing.What kind marketing actions have been taken in the last 3 months? Can you give some examples without the usual tasks (Twitter, blog posts, etc.)?

-

I did some research on Vite's activity on GitHub: on Vite team page there are 23 tech staff but only 5 of them are still active on GitHub, some of them stop their activity at the end of last year and some a few months ago. How many team members are currently working on the technical side of the project?

My research:

https://github.com/Daniel-Leedan/ViteRichard Yan (Vite COO)

Note that the five-person team have marketing responsibilities, but they also deal with operations & community (managing Vite gateway, managing community managers, etc). I didn't say that team was fully dedicated to marketing. Sorry if there was miscommunication.That said, off the top of my head, here are some marketing activities:

-

Binance trading contest

-

Partnership with a variety of projects (the most prominent one being Chainlink)

-

Arrangement for upcoming Binance roundtable discussion (it takes time to get on the guest list)

-

Preparation for coin listing campaign (to be released in 24 hours)

-

Various AMAs with coins listed on ViteX and with other friendly projects

I answered #2 earlier. To supplement, there are private repos that we are working on that outsiders won't see. A few examples:

In Q4 roadmap, you will see that we're adding integration with trading strategy projects. This will allow others to deploy common trading strategies more easily on ViteX. The person working on this has a private repo.

Also, I'm surprised you say there are only five active. Could you share a screenshot? I talk to our developer team regularly, and my job would be a lot simpler if there were only five active!

Bitcoinman

Why there is no effort at promoting Binance trading campaign? No marketing effort from Binance and Vite. No results or Volume increase from that campaign.Richard Yan (Vite COO)